One of the happiest times in life is the period when you find true love and prepare to get married. However, it can also be extremely stressful. Choosing the right partner is the most important financial decision in your life even more important than your home! According to US Census Bureau 2021’s data of US Marriage and Divorce Rates, the ratio of divorces-to-marriages is ~46%. The statistic is even higher for second and third marriages. As a result, many financial advisors may suggest a prenuptial agreement before the wedding. In this blog post, I will share my experience when evaluating the decision for a pre-nuptial agreement, the pros and cons and my rationale for why I decided against it.

Overview of Pre-Nuptial Agreement

What is a pre-nuptial agreement? It is a contractual agreement between couples before marriage that outlines the division of assets and debt in the event of a divorce. These agreements can be straightforward or highly complex depending on each couple’s financial situation.

Most people think that pre-nuptial agreements are only for the super-rich. Professional financial advisors generally raise this topic when you have a few hundred thousand dollars in assets. However, they cite that the big driver is not necessarily the amount of assets but when there are large differences in wealth. If one individual has disproportionately more assets or debt than the other, this is usually when this becomes a discussion.

For most couples, the cost of a prenup ranges from $1,000 to $10,000 per person. The cost varies based on the attorney’s fee and the complexity of the pre-nuptial agreement. For example, if your financial situation is highly complex or you have very specific requests, this may require higher legal fees due to more points for negotiation.

My Experience and Our Net Worth

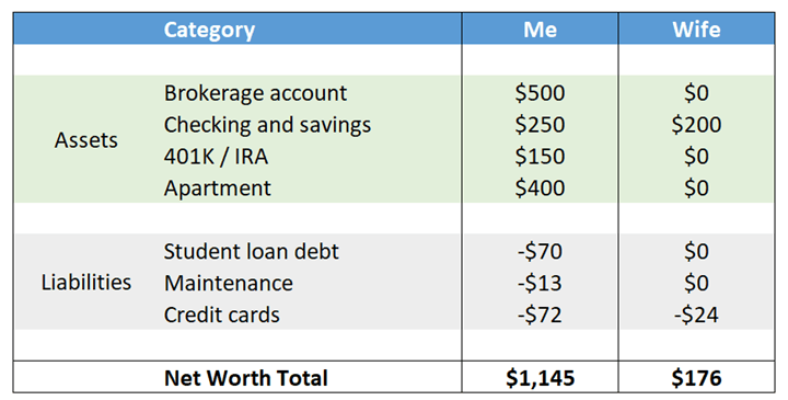

When I first met my wife, I was 29 and she was 28 years old. We were both working in corporate high income jobs in NYC. At that time, I had a net worth of ~$1.1M and she had a net worth of ~$176K as shown in the table below:

Note: My wife did not have any brokerage or retirement accounts because she was on a H1-B visa. There was uncertainty that she might have to leave the US once her visa expired.

My financial advisors encouraged me to consider a prenuptial agreement given the significant disparity in our wealth. They shared horror stories from their clients and how common divorces were in NY. They stressed that I needed to protect myself since we had only been dating for ~6 months. In fact, even my parents asked me to consider a prenuptial agreement in case our marriage failed.

I felt that discussing a pre-nuptial agreement while simultaneously asking her to marry me was akin to the following:

“We’re so great together, let’s get married! But there is just one small thing…I don’t trust you. So, if we get divorced, I am only willing to part with $X. No problem, right?”

Does that proposal make you FEEL EXCITED about marriage?

I shared my discomfort with my advisors and they reassured me that pre-nuptial agreements were very common. They also told me that if she genuinely loved me, she might not care about signing the agreement. Were they right? Was I overthinking it? None of my friends had experience with these agreements and therefore, I could not get a second opinion.

If I chose to do the prenup, was I setting myself up for a failed marriage before it even begins? If I chose to forgo the prenup and we still end up in a divorce, would I regret not having the agreement in place? Having this discussion felt like a poison pill and trying to pick the lesser of the two evils. Assuming I’m able to protect my financial assets, what happens if I were to lose the woman I love.

Would I truly feel wealthy then?

Pros of a Pre-Nuptial Agreement

In evaluating the pre-nuptial agreement, I considered the following advantages from a wealth and happiness perspective:

- Protection of assets pre-marriage (e.g., only have claims to joint assets post marriage)

- Consensus on how to divide previously owned assets that appreciate during the time of the marriage (e.g., real estate, stock portfolio)

- Transparency on finances and honesty of what each party considers “fair”

- “Peace of mind” of whether the other party loves me for me vs. my wealth

- Growing precedent not just among the wealthy, but modern couples

The pros of the prenuptial agreement were straightforward: downside protection on what I already accumulated in life and a window of insight into how important she viewed my wealth on our relationship.

Cons of a Pre-Nuptial Agreement

The potential cons of the pre-nuptial agreement seemed to outnumber the pros:

- Potential meaningless pre-nuptial agreement as there is not much to negotiate which primarily declares: “whatever you have is yours, whatever I have is mine pre-marriage”

- Risk of relationship conflict because I might offend my spouse about the nature of an agreement and her perceptions that she is not an equal partner

- Complexity of future “what if” asset / debt scenarios could result in the inability to settle on an approach that works for everyone, causing more friction and putting your marriage at risk

- Separate legal representation to draft and negotiate the agreement can be expensive

- Having a prenuptial agreement does not preclude future divorce settlements and litigation, potentially having to re-negotiate assets and more complex scenarios (e.g., child care / alimony)

- State laws might supersede certain provisions in a prenup, making it difficult to enforce and may need regular updates depending on your jurisdiction and where you choose to live

After considering the cons, it became more unclear to me what the agreement was actually protecting beyond the pre-marriage assets. The fear of never being able to settle on how to divide joint assets, the emotional toll of negotiating the what-if scenarios and the impact on trust in our relationship were important factors for me.

Rationale Why I Decided Against It

Ultimately, I decided that I could not avoid not talking to her about it. We had to face the first big test of our relationship with a hard discussion. Once we discussed the idea of a pre-nuptial agreement, I was pleasantly surprised. She agreed that given the large disparity in wealth pre-marriage, she was fine with signing a pre-nuptial agreement. She believed it was fair that my assets pre-marriage belonged to me and likewise, her assets belonged to her.

Neither she nor I considered future what-if scenarios of our joint assets. We may have been naïve but we felt that this was too complicated. There could be infinite scenarios that we would have to discuss, which may not even be a reality. What were we negotiating? Additionally, in the event of a divorce, any future joint assets that we accumulated together, we would expect to split 50/50.

Ultimately, we decided NOT to move forward with the agreement because of the following:

- Aligned Values: We both respected the value of money and exercised good judgement when it comes to small and large financial decisions

- Stronger Together: I believed that we grow and scale our wealth much more together rather than separately. What I find as being underrated is the ability to consult each other on major decisions to make the most informed decision for each couple’s specific financial situation.

- Future Asset / Liability Complexity: Coming up with a formula for various hypothetical what-if scenarios that may or may not happen was highly complex and seemed like a wasted exercise.

- Divorce Litigation: If a divorce were to happen, we would likely have to re-negotiate any joint assets at the time anyway and having a pre-nuptial agreement would likely not be very impactful given that we did not consider our pre-marriage assets “significant”.

- Accountability: If I chose wrong or our marriage ended up in divorce, then I would be partially at fault. It is my job to thoroughly vet my future spouse and trying to make my marriage work.

Every couple is unique and I could see the value of a prenuptial agreement in certain circumstances. For example, if this is not the first marriage and there are also significant pre-existing assets, then a pre-nuptial agreement may make sense. It just did not make sense for us.

Consider Financially Compatibility

While the decision for a pre-nuptial agreement is highly personal, I believe it is more important to focus on evaluating the financial compatibility of your spouse. Below, I share a few considerations that helped me determine my spouse’s financial compatibility:

- Does your spouse have a history of making sound financial decisions? (e.g., do they save and invest a large percentage of their pay check, do they live below their means)

- Does your spouse’s family members and close friends have good financial habits? To what extent do they influence your spouse’s decisions?

- Does your spouse have short and long-term financial goals prior to your relationship?

- Does your spouse track his/her finances and spending regularly? (e.g., do they know their numbers?)

- Is your spouse someone that can help you evaluate big financial decisions and can provide “checks and balances”? Can they provide a counter-perspective?

- How does your spouse learn about ways to improve both of your wealth?

Please let us know your thoughts about a pre-nuptial agreement and if you have any other considerations for determining financial compatibility in the comments below. Thanks for reading and we hope you found this post insightful!