Earlier this week, J&J announced an upcoming stock exchange where shareholders will have the option to trade in their JNJ shares for shares of Kenvue, their consumer healthcare company. This is a big upcoming decision for JNJ investors as we need to evaluate which is the better bet. In this blog post, we will summarize the exchange offer, explore the performance of other healthcare spin-offs, and discuss the rationale for and against exchanging JNJ shares for Kenvue.

Warning: The is an extensive post covering a significant amount of background material and in-depth analyses. If you are only interested in how we plan on handling the exchange, please skip to the end.

Disclaimer: I am currently a J&J shareholder and please do not interpret my views as investment advice. Additionally, any numbers shared below may be outdated by the time you read this post. Please perform your own research and analysis. Consult your financial advisor before making any investment decisions.

J&J and Kenvue Business Overview

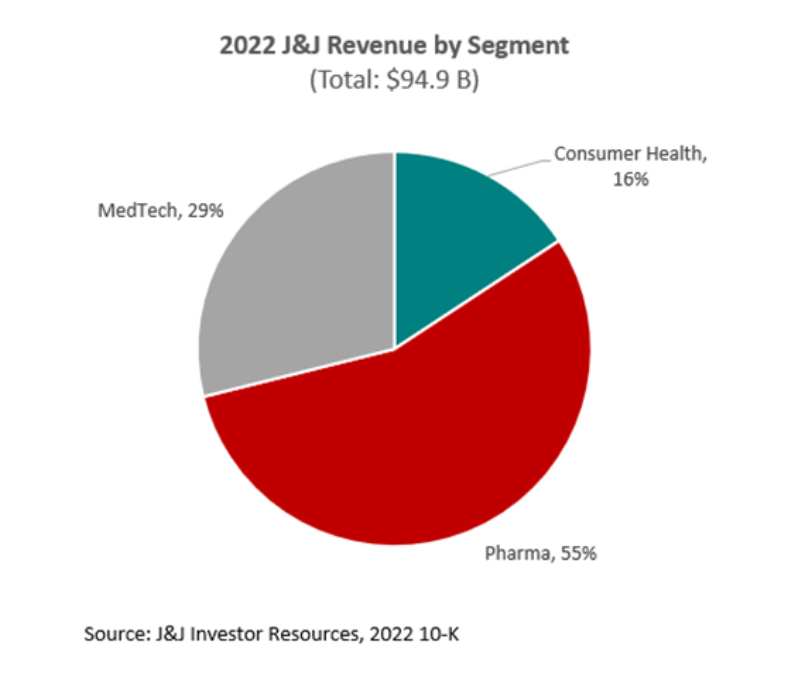

Currently, J&J’s business consists of three business segments which include consumer healthcare (Kenvue), pharmaceuticals, and MedTech. For FY 2022, the revenue contribution for each of these businesses is as follows:

The consumer health business represents ~16% of total J&J sales across three sub-businesses: self-care, skin health & beauty, and essential health. Overall revenue is well-diversified across each business segment (~29% for Skin Health, ~30% and Essential Health, and ~41% for Self Care) as well as geographic footprint (~50% US, ~50% ex-US). The most iconic household brands include Benadryl, Tylenol, Band-Aid, Neutrogena, Aveeno, Johnson’s, and Listerine.

J&J anticipates the spin-off will improve strategic execution and increase operating leverage among all businesses. Another key motivation behind the separation is to manage the liabilities from the talc product-related lawsuits. The litigation centers on over ~60K lawsuits claiming that the company’s talc-based products caused ovarian cancer and mesothelioma.

J&J formed a separate subsidiary, LTL Management, and immediately filed for bankruptcy to efficiently settle litigation claims. However, a US Federal bankruptcy judge denied J&J for the second time and J&J may have to re-appeal again. This implies that future liabilities from the talc lawsuits may be higher for J&J beyond the latest $8.9B estimate, possibly giving plaintiffs more leverage. The judge’s bankruptcy decision only impacts J&J’s liabilities in the US and Canada because Kenvue is responsible for claims in all other geographies.

In analyzing each segment’s revenue over the last 5 years, the Pharma business has primarily driven the parent company’s sales growth, with a 5-year CAGR of 5.2%.

However, there are several challenges facing the pharma business. Approximately ~24% of its drug portfolio sales has experienced declining operational growth in 2022 vs. 2021. Additionally, blockbuster brand Stelara will face patent expiry in late 2023. J&J’s strategy to convert patients from Stelara to Tremfya has had limited success. Increased competition, payer discounts, and the lack of overlapping indications and formulations remain barriers to patient conversion. For its cancer business, Imbruvica continues to face increasing competition and Medicare rebate pressures.

For J&J’s MedTech business, the growth has been relatively flat in the last few years due to patients delaying elective procedures because of COVID. However, demand has recovered and according to J&J’s latest 2023 2Q earnings report, sales from MedTech rose ~12.9% from a year ago. Additionally, its recent acquisition of Abiomed may help support future growth goals.

We also analyzed each segment’s income as a percentage of its revenue as an indicator of profitability. Over the last 5 years, the pharma and MedTech businesses were considerably higher than Consumer Health:

- Consumer Health: ~10.8%

- Pharma: ~30.1%

- MedTech: ~18.1%

Proposed Stock Exchange Deal

Based on JNJ’s recent investor announcement, the main highlights of the proposed exchange offer are as follows:

- J&J will permit shareholders to exchange some, all, or none of their stock for common shares of KVUE subject to an upper limit of 8.0549 shares of KVUE for every share of J&J. If the upper limit is NOT in effect, J&J will provide shareholders with approximately $107.53 of KVUE common stock for every $100 of J&J stock.

- J&J anticipates offering KVUE stock at a ~7% discount with the exchange offer being a tax-free distribution.

- J&J will determine the prices at which shares will be exchanged based on the daily volume-weighted average prices of shares on August 14, 15, and 16. The final exchange ratio reflecting the number of shares of KVUE stock to be received for each J&J share will be on August 18th, 2023 at 9 AM EST

- Investors will need to elect whether they want to participate in the exchange by August 16th, 2023.

Additionally, if the exchange is undersubscribed by August 18th, J&J plans to make a tax-free distribution of Kenvue shares to existing JNJ shareholders as a dividend seven business days following August 18th. For 2023 forward-looking guidance, J&J expects ~4.4% revenue growth and Kenvue expects 4.5% to 5.5% sales growth.

The strategic question facing investors is:

Would you trade some shares of a historically higher growth, higher profitability business for a modest growth, lower profitability business in consumer healthcare?

Valuation of J&J and Kenvue

Before evaluating analog case studies, we want to determine the current valuations of J&J and KVUE. These valuations may inform whether investors will receive good value at the time of the exchange. (Please note that there are multiple valuation approaches and you should conduct your analysis.)

For example: If current stock prices suggest that J&J is overvalued and Kenvue is undervalued, then J&J shareholders may consider reducing some exposure and re-allocate their capital into Kenvue. Kenvue’s current valuation may also provide a baseline for how attractive the incremental ~7% discount incentive might be at the time of the exchange.

Using FinViz and analyzing the P/E, Forward P/E, and PEG ratios, we compared JNJ relative to other S&P 500 healthcare drug manufacturers below:

With JNJ trading at a 34.6 P/E, 15.29 Forward P/E, and 8.15 PEG ratio, it is higher than not only the segment median but also its historical P/E of 17.3 since 2009. If we use J&J’s forward P/E of 15.29 and the 2023 consensus annual EPS of $10.76, the intrinsic value of the stock price should be ~$164.52. Based on the stock’s previous close of $174.48 as of Jul 28th, we believe J&J is slightly over-valued.

We performed a similar analysis for Kenvue relative to other NYSE Consumer Defensive – Household & Personal Care companies below:

Kenvue’s current P/E of 21.8 is below the segment median and also has a lower forward P/E of 19.6 than the segment median of 24.7. By applying its forward P/E of 19.16 to the projected 2023 consensus forecast of $1.25, the estimated intrinsic value is $23.95 per share. As of July 28th, the stock price closed at $24.40 per share, suggesting that Kenvue is priced fairly.

If the stock continues to hover around the same price leading up to the exchange, J&J’s offer to distribute Kenvue at a 7% discount to the market price could be attractive.

Performance Impact of Case Studies

While no one can predict the future, we analyze three case studies of similar company spin-outs to inform possible JNJ-KVUE scenarios.

Pfizer and Zoetis

Pfizer decided to split its Human Health and Animal Health business (Zoetis) in 2013. Similar to J&J and KVUE, they presented a similar tax-free stock exchange offer. Pfizer shareholders would be able to exchange 1 PFE share for 0.9898 shares of Zoetis stock (ZTS) at a 7% discount to the market price. Much like J&J, Pfizer initially owned ~80% of the common stock of Zoetis, and sold all remaining shares via the exchange.

Using Portfolio Visualizer, we back-tested these two companies, assuming a $10K initial investment balance, and evaluated the performance following the spin-off from 2014 to 2018 below:

The total return during that period for PFE was 70%, but was 172% for ZTS! Additionally, when analyzing the revenue growth and annual diluted EPS growth for both companies during this time period, we see that ZTS outperformed significantly across all metrics.

Following the spin-off, Zoetis outperformed Pfizer as a result of multiple factors which included:

- Pfizer’s failed attempt to buy AstraZeneca in 2014

- Pfizer experienced declines in earnings, lower sales from Lipitor and Viagra as a result of patent expiry as well as decreases in revenue from other established brands

- Zoetis saw higher demand for its premium livestock products and launched several new products

GSK and Haleon

In July 2022, GSK also completed the spin-off of its consumer healthcare business, Haleon. At the time, GSK co-owned Haleon with Pfizer with GSK owning 68% of Haleon and Pfizer owning 32%. As part of the spin-out, GSK looked to reduce its 68% holding by 80%.

While there is limited historical performance data, GSK-Haleon is also a spin-out of the parent company’s consumer healthcare business. GSK shareholders would receive 1 share of Haleon for each share of GSK. This is different from J&J’s proposed exchange offer as it is not an exchange. Following the transaction, GSK also consolidated shares to stabilize price and earnings by giving 4 new shares of nominal value at 31.25p for every 5 GSK shares of nominal value of 25p. Management suggested that the spin-out would drive revenue and earnings per share growth with Haleon growing by 4% to 6% annually and GSK growing by 6% to 8% in 2023.

Additionally, Haleon launched with a significant amount of debt (~£10.9B pounds), around 3.6X of its adjusted EBITDA and an extremely high debt-to-equity ratio at 64.5% (£10.6B debt / £16.5B equity). Kenvue, on the other hand, has a total debt of $7.8B, which is ~2.1X its adjusted EBITDA and brings its debt-to-equity ratio to 38.4%. As previously mentioned, this debt could be even higher depending on the outstanding talc lawsuits.

Back-testing a portfolio of GSK and Haleon in Portfolio Visualizer, the initial results have been underwhelming. This may be due to the limited time horizon since operational and financial synergies usually require a 3-to-5-year time horizon.

In reviewing the 1-year stock performance from Google Finance, GSK has declined by -16.45% and HLN has risen by 24.14%. While this might look attractive, forward-looking revenue and annual diluted EPS analyst estimates might suggest a different interpretation for HLN.

Analysts expect that revenue will grow by 4% and EPS will decline by -3%. While the spin-out of the consumer business is similar to J&J, the pharma business of J&J vs. GSK is extremely different. J&J has a much more clinically innovative portfolio and has many market leaders in their disease areas, as well as the MedTech business. GSK’s portfolio has recently had several pipeline failures in its oncology business and has mostly been anchored by its legacy HIV and respiratory franchise.

For these reasons, we need to be cautious about how we interpret the 1-year performance of GSK and HLN for J&J and KVUE.

Merck and Organon

In June 2021, Merck announced the strategic decision to spin off its Women’s Health, Biosimilars, and Established brands business called “Organon”. Merck’s focus on its oncology, vaccines, and specialty care business diluted its attention away from Organon, leading to historical underperformance. As a result, they felt separating the two companies would lead to improved growth and shareholder value creation.

Unlike J&J-KVUE, the separation was not an exchange offer. Merck shareholders would receive 1 share of Organon (OGN) for every 10 shares of Merck common stock. According to investor presentations, management estimated low-to-mid single-digit revenue growth from the 2021 base for Organon and deliver up to 1% CAGR improvement on Merck’s revenue growth.

Back-testing a portfolio of Merk (MRK) and Organon (OGN), we can only evaluate a 1-year performance given the recent timeline of this transaction.

Merck has so far, greatly outperformed Organon in its total return. Merck’s 1-year return is ~17% while OGN has declined -32.6%! Organon’s revenue has slipped in 2022 as well as its annual diluted EPS largely attributed to declines in its established brands as well as the foreign currency exchange impact. Over 75% of OGN’s business is outside the US.

Among the case studies above, only the Pfizer-Zoetis transaction has a similar exchange offer and presents the most comprehensive historical performance given a 5-year lookback period. The GSK-Haleon and Merck-Organon examples were not exchange offers. However, Zoetis’ Animal Health business is very different compared to Consumer Healthcare. Some of these key differences include:

- Higher profitability for Animal Health (Zoetis) vs. Human Health (Pfizer) compared to lower profitability for Consumer Healthcare (Kenvue) vs. Pharma/MedTech (J&J)

- High barrier to entry for Animal Health due to required customer infrastructure with veterinarians and livestock farmers with dedicated field sales force vs. greater emphasis on digital for Consumer Health

- Greater protection from competition and generics entry in Animal Health vs. Consumer Health

- Launch of multiple new pipeline products and formulations

While no analogy is perfect, it appears that initially, stock prices have risen for Zoetis and Haleon following the initial IPO. However, Kenvue is down ~8 to 10% from its IPO price year-to-date. However, Kenvue recently announced strong Q2 earnings, suggesting a positive sign for their first quarter as an independent company. To what extent do you believe Kenvue can consistently exceed revenue and earnings growth in the coming quarters?

Reasons Supporting A KVUE Exchange

Below, we summarize potential reasons that might support exchanging a portion of JNJ shares for KVUE shares:

- JNJ is currently modestly overvalued and KVUE fairly valued. Take profit and invest in a quality company

- “Hedge” against future pharma business headwinds (e.g., Stelara LOE, IRA & rebate pressures, increased competition / declining brands)

- Unresolved talc product litigation may result in significantly higher settlement requirements for JNJ

- 7% upfront discount on KVUE and expected return may be attractive if future performance is similar to Zoetis; better than expected Q2 results supports strong execution since the separation

- Iconic and resilient brands with brand equity and growth despite economic slowdown

- Manageable debt levels with KVUE and JNJ more exposed to talc product liabilities (assuming eventual LTL bankruptcy approval and no further increase to aggregate settlement)

Reasons For No Share Exchange

Similarly, we summarize potential reasons that do not support exchanging a portion of JNJ shares for KVUE shares below:

- Preference not to dilute JNJ returns by replacing higher growth, higher profitability business with modest growth and lower profitability business

- Higher longer-term valuation multiples for Pharma and MedTech businesses given the pharma portfolio focus in oncology and cell & gene-based therapies as well as its recent MedTech acquisition (Abiomed)

- Consumer Health business model is highly commoditized with heavy competition (e.g., low margin, high volume) requiring significant consumer digital engagement and DTC advertising

- Not sacrificing “diversification” with spin-off because Consumer Health is only ~15% total sales and existing Pharma and MedTech businesses are already highly diverse

- Uncertainty for KVUE to achieve performance goals next 3-5 years based on analog execution

Final Considerations

Remaining Unanswered Questions

There are still several unanswered questions leading up to the exchange, some of which may include:

- How will the exchange and the number of shareholders that opt in affect the stock price for both J&J and Kenvue?

- If the exchange offer is under or over-subscribed, what will J&J’s approach be towards the remaining shares?

- How will the spin-out impact J&J’s reported annual revenue, EPS estimates, and dividend? (Do the existing annual estimates include or exclude Kenvue operations?)

- How does the recent decision by a US bankruptcy judge to deny LTL’s bankruptcy status impact pending talc-litigation and future debt implications for J&J?

- What will Kenvue’s dividend growth policy be moving forward?

Our Decision on Exchanging Shares

Will you be trading some of your J&J shares for KVUE? Personally, my wife and I are long-term investors and will likely hold on to our J&J shares. We are unlikely to participate in the exchange offer for Kenvue. Our main reasons include the following:

- Higher compounded growth and profit for its two core businesses (pharm and MedTech), likely resulting in higher valuation multiples in the future

- JNJ Pharma headwinds are largely industry-wide and J&J has a strong track record of navigating short-term portfolio challenges (e.g., patent expiration, rebate negotiations)

- Not originally planning on selling JNJ due to talc litigation risk

- Not losing JNJ diversification since Consumer Health business is only 15% and Pharma and MedTech portfolios are already very well-diversified

- Limited performance data available for Kenvue, remaining unanswered questions prior to exchange decision and the option to always buy at a later date

Additionally, there is always the option to buy Kenvue at a later date if we desired greater consumer health exposure beyond the S&P 500. Thanks for reading this long post and we hope you find our analysis helpful! Please let us know your thoughts on whether you plan on participating in the exchange on August 18th.