Airbnb has revolutionized the way people travel and invest in real estate. We detail each important step in starting an Airbnb business, from understanding the nuances between traditional and Airbnb investments to financial planning to day-to-day operational management. Whether you’re a seasoned investor or a newcomer looking to start an Airbnb business, we’ll help you navigate the complex world of Airbnb entrepreneurship.

Step 1: Understand the Differences Between Airbnb & Traditional Investment Properties

Airbnb and traditional investment properties serve different markets and come with unique sets of expectations and management styles. Owning an Airbnb typically means short-term rentals—offering fully furnished accommodations for vacationers or travelers. These often yield higher rental income per day compared to traditional rentals, but this comes with greater host involvement in frequent cleaning, maintenance, and guest communication.

On the other hand, traditional investment properties—also known as long-term residential rentals—usually provide a steady monthly income with longer tenant leases. These generally require less daily management as well as less flexibility in pricing and tenant turnover.

Here is a simplified table comparing the two types of investments:

When deciding whether you want to start an Airbnb business, investors should consider several critical factors. Assess the market demand and competition in the desired area to ensure a profitable venture. Understand the commitment involved, including the time and resources needed for daily operations, guest communication, and property maintenance.

Consider the financial implications, such as initial investment, ongoing costs, and the potential for fluctuating income based on seasonality and market trends. Also, reflect on your personal goals and lifestyle, as running an Airbnb requires a hands-on approach and can significantly differ from traditional investment properties or other forms of passive income.

Step 2: Learn the Legal Framework & Compliance for Airbnb

Given the diverse and often stringent regulations governing short-term rentals, investors should understand the legal landscape before starting an Airbnb business. Airbnb is subject to various local laws, including short-term rental regulations, tourism taxes, and in some cases, stricter zoning laws. The reasons for the stringent regulations are due to the following concerns:

- Community impact: Short-term rentals can significantly affect local communities. Issues can arise related to noise, safety, and housing availability. This is particularly evident in areas where rental properties are converted to short-term lets, reducing long-term rental supply. Regulations are often designed to mitigate these impacts.

- Tourism control: Many cities rely on tourism but must balance it with local quality of life. Regulations may aim to control the number of tourists in certain areas, maintain the character of neighborhoods, and ensure that tourism growth is sustainable and beneficial to the local economy.

- Fair competition: Traditional lodging businesses, like hotels, are subject to regulations and taxes. As Airbnb operates in the same market, local laws aim to level the playing field by ensuring short-term rentals meet similar standards and tax obligations.

- Safety and standards: Regulations often enforce safety standards for guests, including fire safety, health standards, and building codes, similar to other accommodation services.

- Revenue collection: Tourism taxes, like hotel occupancy taxes, are a significant revenue source for many local governments. Applying these taxes to Airbnb rentals ensures that the city benefits financially from the tourism facilitated by these platforms.

- Zoning laws: Residential zones are typically designed to maintain a certain character and use within a community. Short-term rentals can change the nature of a neighborhood, leading to stricter zoning laws to control where and how these businesses operate.

Understanding how to start an Airbnb business should encourage investors to do their due diligence. You can do this by researching zoning laws, licensing requirements, and specific restrictions on short-term rentals in the area you want to have an Airbnb. Additionally, if your property falls under the jurisdiction of a Homeowners Association (HOA), you must review and adhere to its bylaws.

Some may have restrictions or outright bans on short-term rentals. Ensuring compliance with these various legalities not only avoids penalties and fines but also ensures you are investing your money in a legally sound, sustainable venture that is more likely to yield long-term benefits and maintain good standing in the community.

Step 3: Plan the Finances for Your Airbnb Business

How much you can make on Airbnb goes beyond the initial property purchase and requires deep financial planning. Before even selecting your property, investors should create a detailed budget or business plan. This budget should consider the initial setup costs, such as renovation and furnishing, and ongoing expenses like utilities, maintenance, and cleaning.

Hosts must also account for Airbnb’s service fees and set aside funds for unexpected repairs. Develop a dynamic pricing strategy that reflects demand fluctuations, local events, and seasonality to maximize revenue. Additionally, understanding and planning for taxes, including income, property, and occupancy taxes, is necessary. Effective financial planning enables hosts to price their listings competitively, cover all costs, and ensure a profitable and sustainable business model.

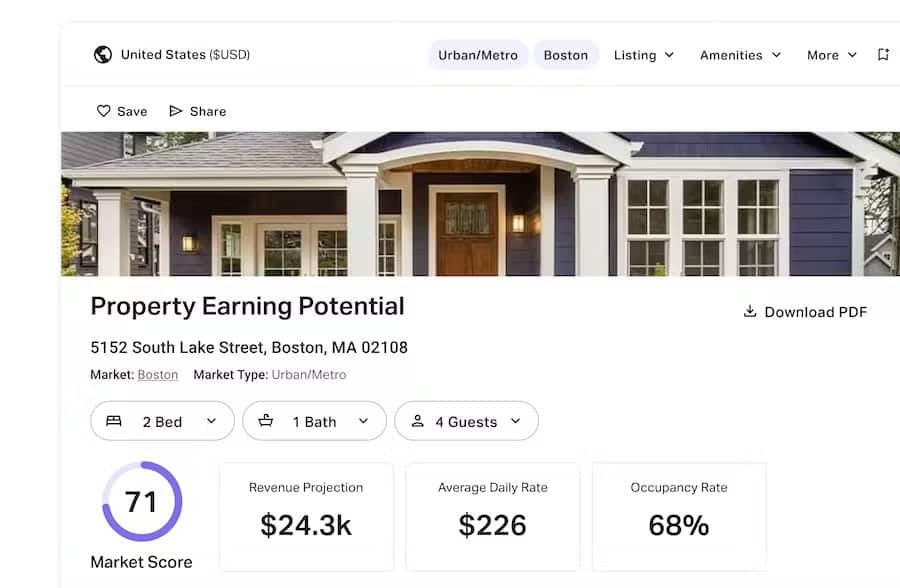

Property evaluation (Source: AirDNA)

Platforms like AirDNA can help investors learn how to get into Airbnb and understand how to price their property by providing comprehensive market data and analytics. These offer insights into revenue potentials, occupancy rates, and competitive pricing strategies within specific locales. By analyzing trends, seasonality, and even event-driven demand, investors can optimize their pricing to maximize occupancy and revenue. With such data-driven approaches, investors can make informed decisions, adapting their pricing strategies to market changes and demand patterns, ultimately leading to a more profitable and efficient operation.

Visit AirDNA

Step 4: Structure Your Business & Financial Management

For many investors, forming a Limited Liability Company (LLC) or real estate holding company is a preferred choice due to the distinct separation it offers between personal and business assets, as well as potential tax benefits. An LLC can provide a layer of protection while also enhancing the professionalism of your business.

Alongside this, it’s essential to maintain separate financial accounts for personal and business transactions. Keeping meticulous records for tax purposes and considering professional accounting support can be helpful to an Airbnb investor. Below is a table outlining the pros and cons of operating your Airbnb under an LLC to help you make a more informed decision:

Not every Airbnb is listed under an LLC. If you want to be a small-scale host managing just one property or part of your home, the additional complexity and cost of forming an LLC might not be justified. Personal homeowners insurance and additional short-term rental coverage might be sufficient for your liability needs without needing an LLC’s protection.

Also, some investors may find that their current mortgage or property management agreements have stipulations or complexities that make transferring to an LLC disadvantageous or impractical. For those who are just testing the waters of being an Airbnb host or doing it casually, the informal structure without an LLC can be a simpler and more direct way to start.

Accounting dashboard (Source: QuickBooks)

QuickBooks can be an incredibly useful tool for keeping the finances of your Airbnb business separate from your personal finances. As a comprehensive accounting software, QuickBooks allows you to track all your business transactions, expenses, and income in one place, ensuring a clear distinction between personal and business cash flows. It offers features tailored to rental property management, such as categorizing expenses, tracking tenant payments, and managing multiple properties. Additionally, the platform provides detailed financial reports, which can be invaluable for analyzing your business’ performance and preparing for tax season.

Visit QuickBooks

Step 5: Select the Ideal Property for an Airbnb Investment

Owning an Airbnb in an ideal property and location is pivotal in establishing a successful Airbnb business. The right choice can lead to high occupancy rates, positive reviews, and increased revenue—while a poor choice might result in the opposite.

The first step is understanding the market demand in your target area. Research popular destinations, understand the seasonal flux of tourists, and identify any events or attractions that draw visitors. Take a look at the competition nearby. Understand what kinds of properties are available and what their occupancy and pricing strategies are.

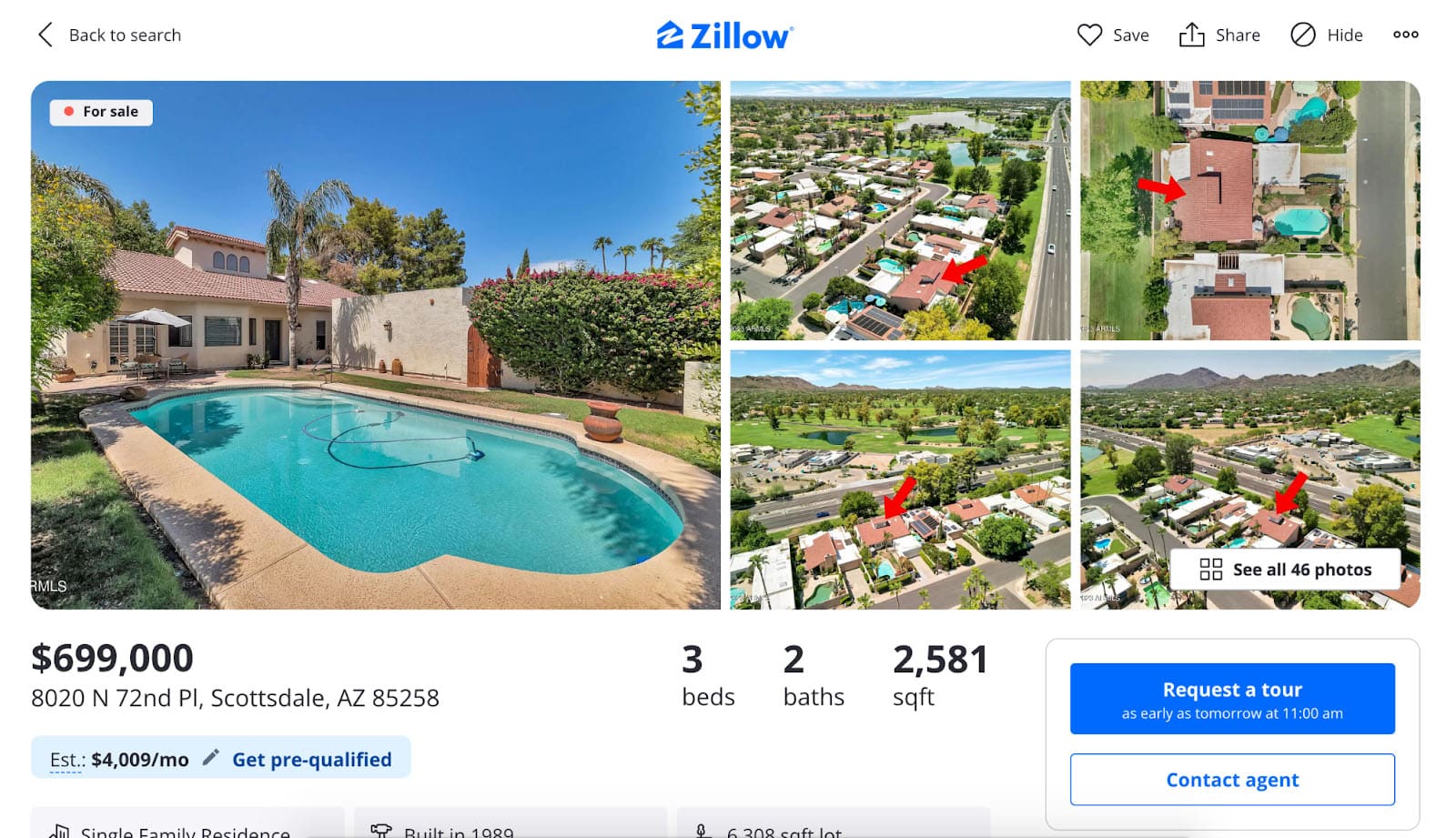

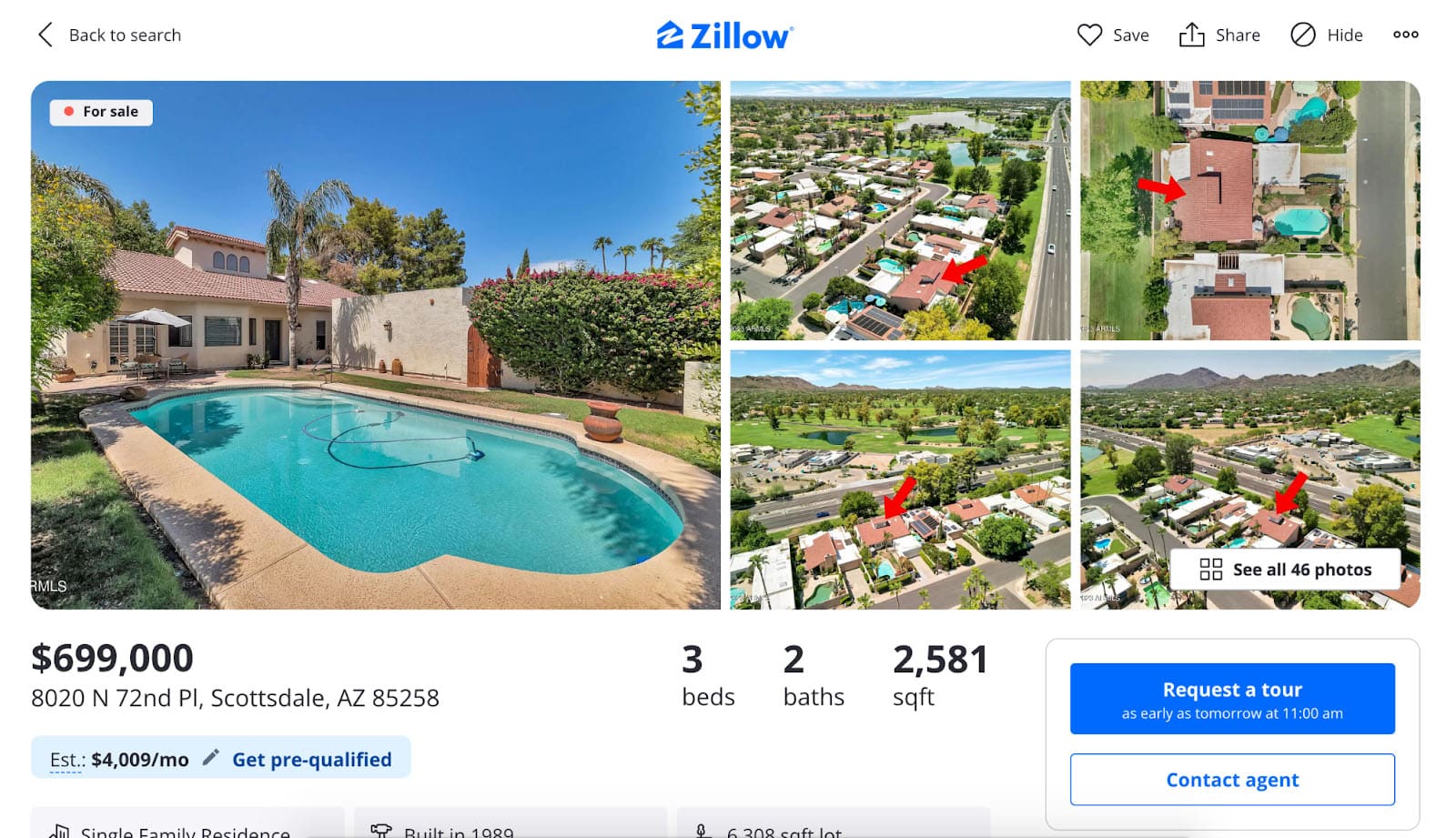

Ideal location for warm rental destination (Source: Zillow)

Once you grasp the market and how to own an Airbnb, consider the specifics of the location. Properties in central, accessible areas or nearby major tourist attractions typically command higher prices and enjoy higher occupancy rates. However, these properties might also have higher purchase prices and more stringent regulations. Alternatively, if marketed correctly, unique or secluded properties can attract a niche market. Accessibility is key, so properties should ideally be near public transport, airports, or have convenient parking options.

Why the Location of Your Airbnb Matters

The property itself is just as crucial as its location when learning how to start an Airbnb business. Consider the type of guests you want to attract and ensure the property meets their needs. For example, families might look for multiple bedrooms and a kitchen, while business travelers might prioritize a dedicated workspace and high-speed internet. The property’s condition and potential for customization should also be considered. Investing in high-quality furnishings and decor can significantly enhance the appeal of your Airbnb listing.

Make sure your Airbnb is in a location that is accessible to you or a co-host. Being nearby or having a reliable co-host is crucial for managing the day-to-day operations efficiently. This proximity allows for quick response to guest issues, regular maintenance, and easier management of check-ins and check-outs.

If you or your co-host can be readily available, it ensures a higher level of service and satisfaction for guests, leading to better reviews and potentially more bookings. Additionally, being close to the property reduces the reliance on third-party services for emergency repairs or unexpected guest needs, saving time and money in the long run.

Step 6: Market Your Airbnb Listing

Similar to marketing a traditional rental property, a well-crafted Airbnb listing can make the difference between frequent bookings and a vacant property. Investors must ensure their listing is constantly updated and reflect the latest amenities, improvements, and guest feedback. By actively managing and updating their listing, investors can maintain a competitive edge, attract a steady stream of guests, and maximize their rental income.

Here are strategies to effectively create and market your Airbnb listing:

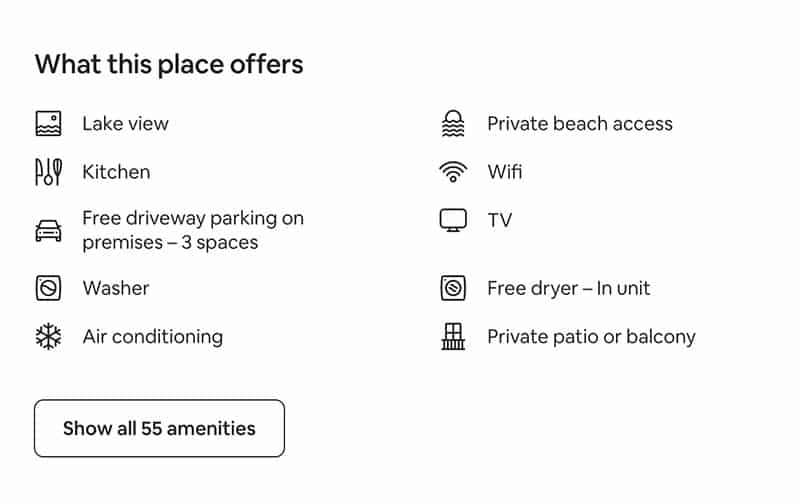

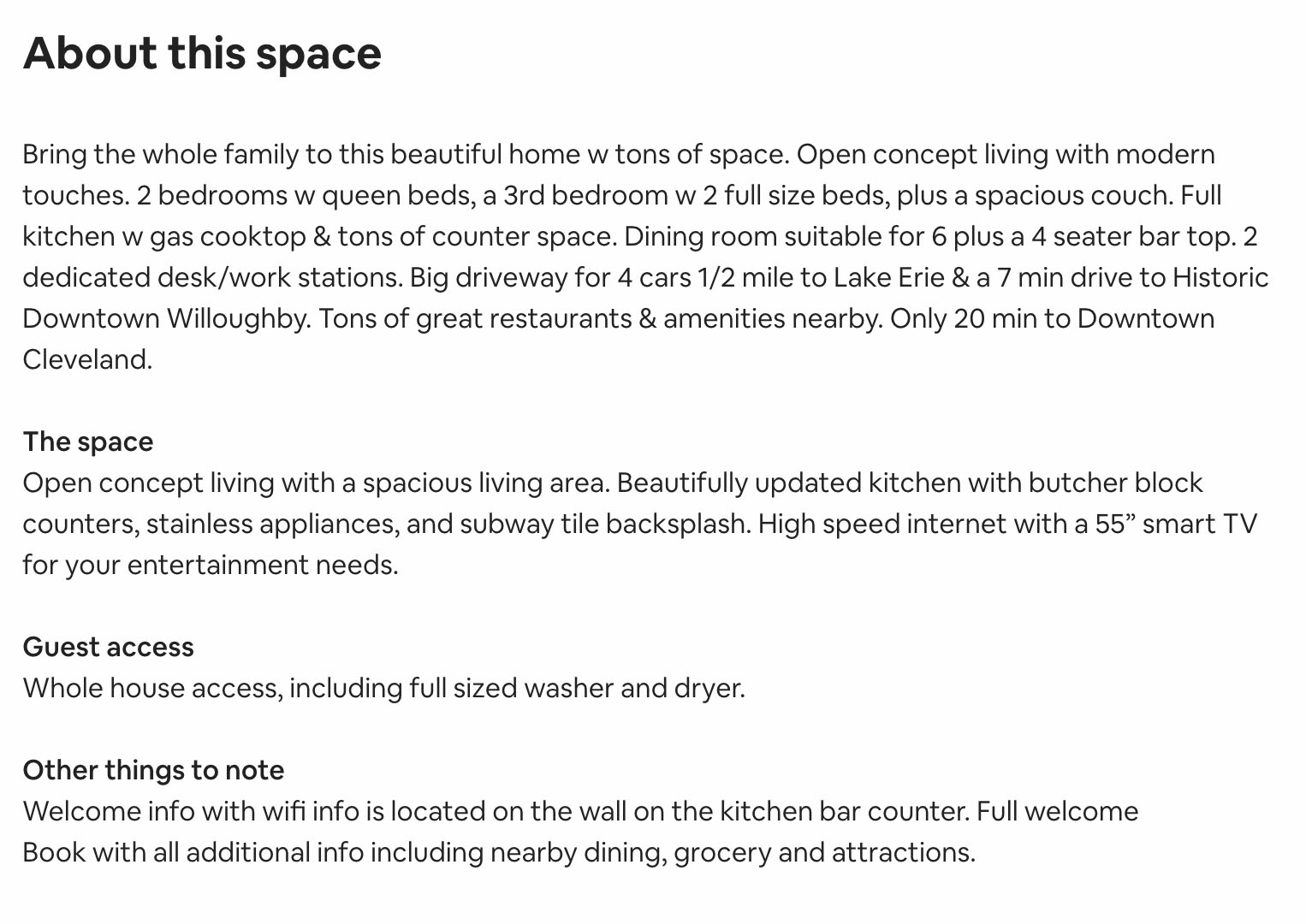

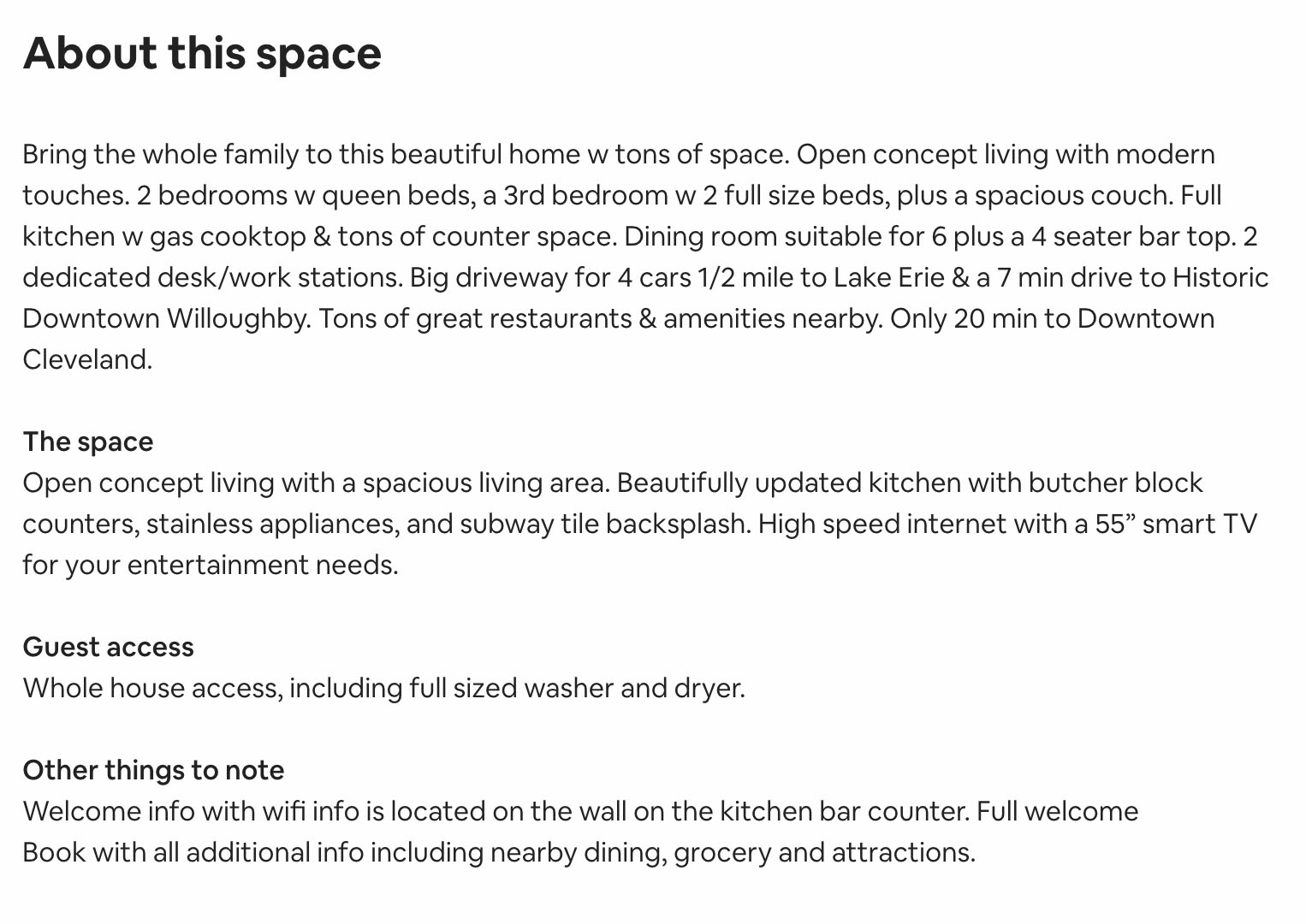

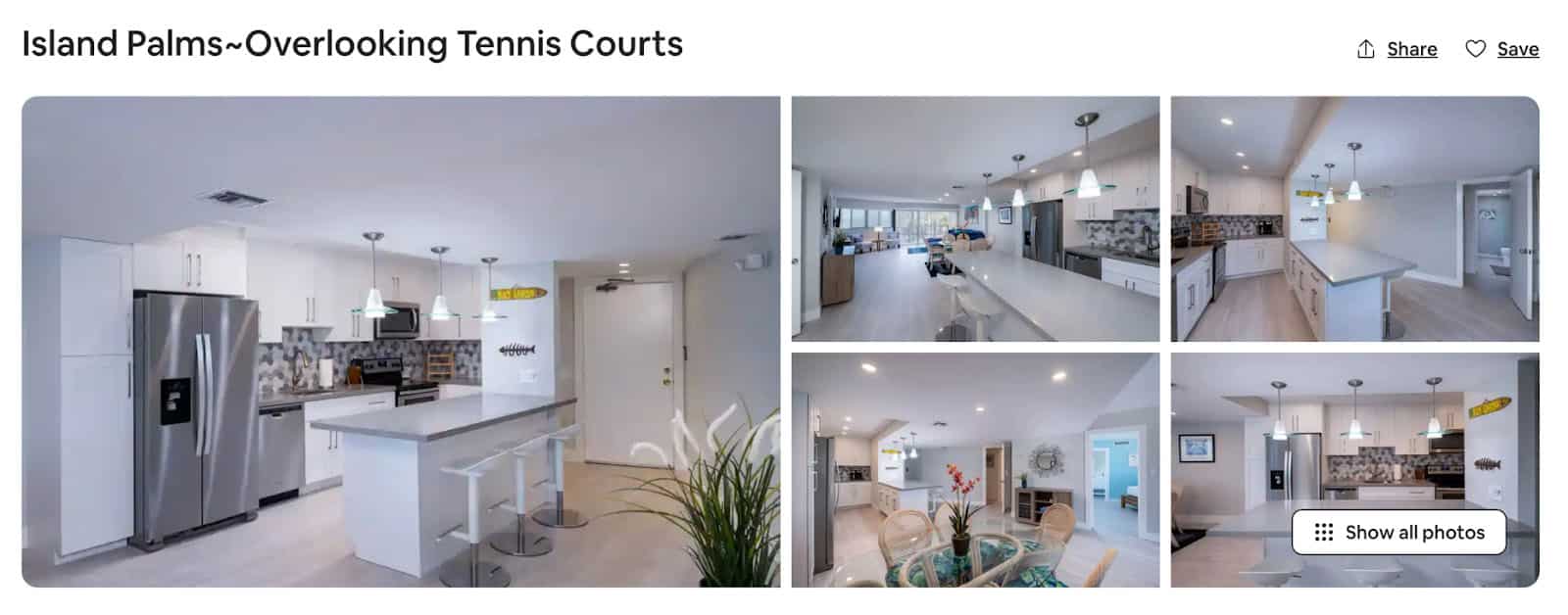

Your listing should serve as an inviting snapshot of what guests can expect. Start with high-quality photos that showcase the cleanliness, style, and unique features of your property. Write a description highlighting the amenities and any unique aspects of your home or location. Be sure to list all the amenities accurately, emphasizing those that make your space stand out, such as a scenic view or a fully equipped kitchen.

Airbnb property description (Source: Airbnb)

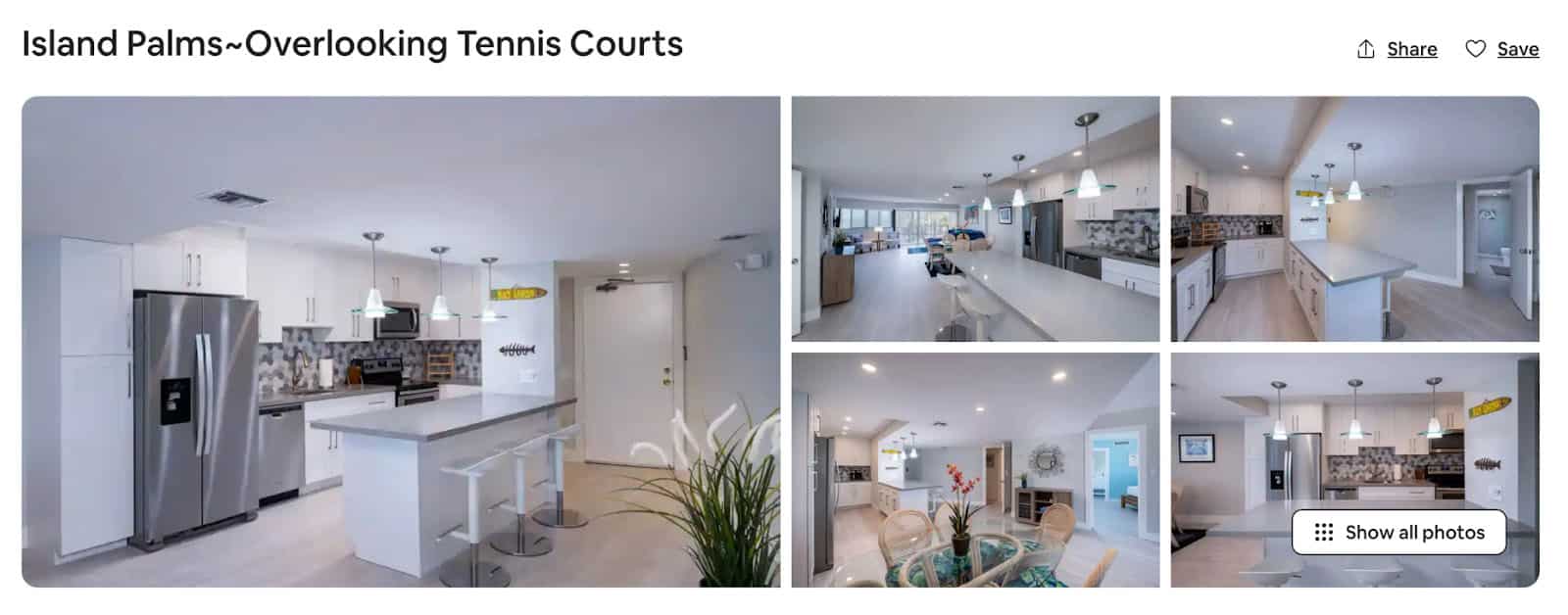

One key piece of your listing that should not be overlooked is the title of your Airbnb listing. It is your first opportunity to attract potential guests. It should be attention-grabbing, informative, and concise, encapsulating the essence of your property and its unique selling points. Think of it as a headline that promises a story.

Whether it’s the cozy ambiance of a mountain cabin, the sleek style of a city studio, or the unbeatable location of a beachfront villa, you want to use strong, descriptive words and focus on what sets your property apart. A well-crafted title can intrigue and draw guests to click through, explore your listing in detail, and ultimately book their stay.

Example of creative Airbnb listing title (Source: Airbnb)

Knowing how to make money with Airbnb involves setting the right price for your property. It is a delicate balance that can significantly impact your rental’s success. Begin by researching the local market to understand the going rates for similar properties. Look at factors such as location, size, amenities, and the quality of other listings to benchmark your price competitively. Consider the unique aspects of your property that might allow for a premium or require a pricing adjustment, such as a spectacular view, recent renovations, or additional services, like parking or breakfast.

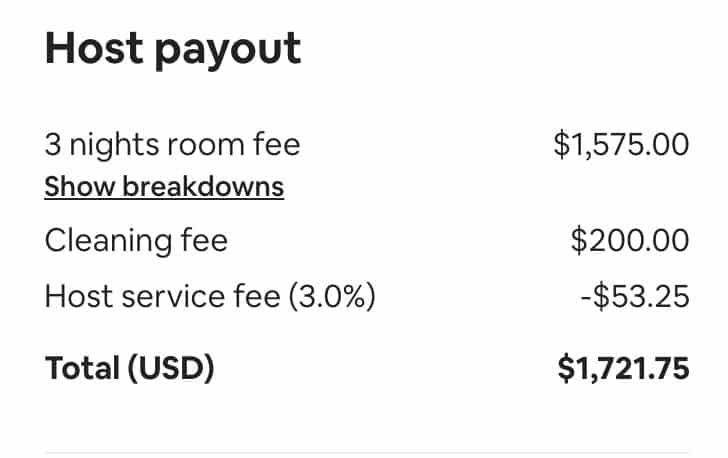

Host payout calculations (Source: Airbnb)

When setting your prices, consider the fees associated with using platforms like Airbnb, as well as cleaning fees and taxes, which can affect your net earnings. It’s important to be transparent with guests about these additional costs. Keep in mind that while higher prices can mean more revenue per booking, they might lead to fewer bookings overall. Conversely, lower prices might increase occupancy but reduce your profit margin.

Investors should consider what potential guests might search for, such as “cozy cabin near hiking trails” or “downtown luxury condo.” Use these real estate keywords naturally and appealingly to describe your property. Also, include details about the neighborhood, proximity to popular attractions, or any unique features of your home. This not only helps guests find exactly what they’re looking for but also improves your listing’s visibility in search results.

Keeping your listing information up to date is equally important to helping increase your search engine optimization (SEO). Regularly refresh your content with the latest amenities, any new decor or renovations, and updated photographs. This shows potential guests that you’re actively maintaining the property and ensures your listing reflects the current guest experience. It’s also important to update your availability calendar and pricing to reflect any changes in your schedule or strategy.

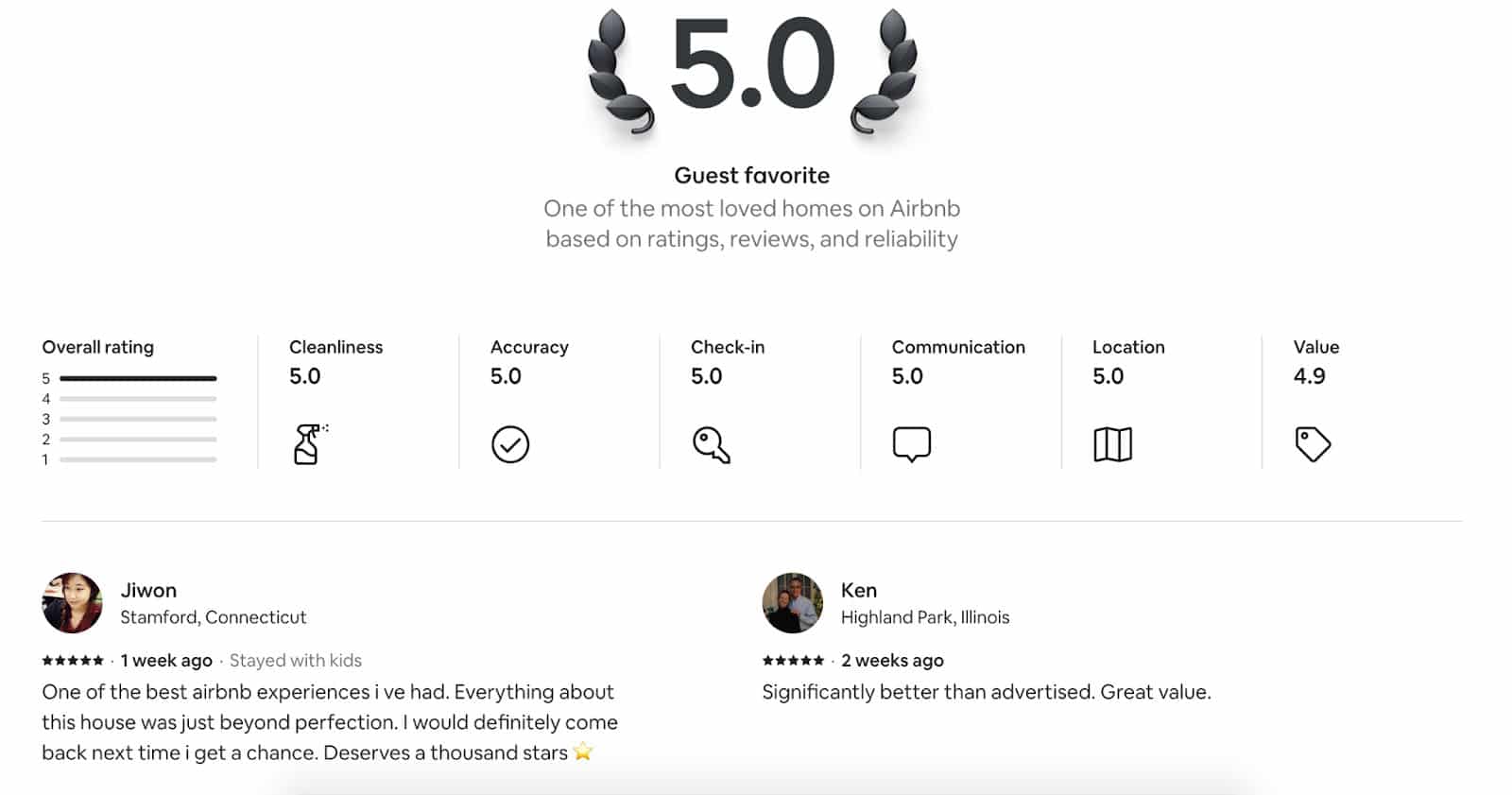

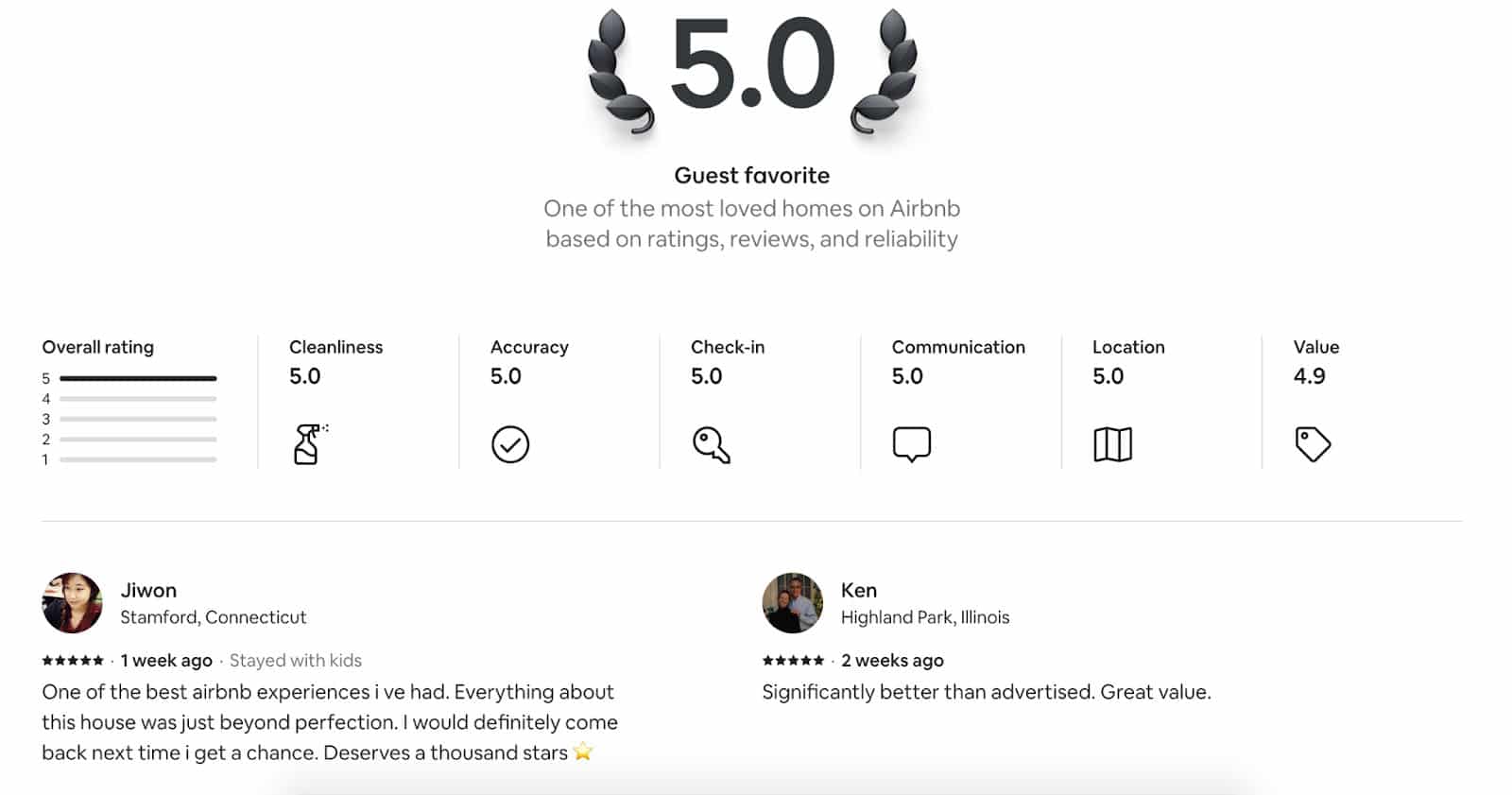

Reviews act as a testament to the quality and appeal of your property. These provide prospective guests with firsthand accounts of what to expect and can significantly influence their decision to book. To encourage satisfied guests to leave reviews, consider sending a personalized thank-you message after their stay, expressing your appreciation for their visit and kindly asking them to share their experience. Some hosts automate a friendly note to guests to encourage them to leave a review.

Airbnb

As a host, you also have the opportunity to provide feedback on your guests. Your reviews about the guest’s conduct, communication, respect for your property, and adherence to your house rules contribute valuable insights for future hosts. If your experience with a guest was positive, leaving a favorable review not only acknowledges their good behavior but also fosters a reciprocal appreciation that might encourage them to leave a positive review of your property.

Staying informed about market trends and new marketing techniques is also crucial to keep your listing competitive and appealing. This might involve understanding shifts in traveler preferences, such as an increased interest in sustainable travel or accommodations that offer work-friendly spaces. It also means keeping an eye on new features or promotional opportunities on the Airbnb platform and broader marketing trends like virtual tours or leveraging influencer marketing.

Adapting to guest preferences and industry changes is key to maintaining and growing your Airbnb’s success. This could mean periodically refreshing your listing’s decor to keep it trendy and appealing, adopting new technologies for ease of access and communication, or altering your pricing strategy to reflect demand spikes and dips in the travel industry.

Step 7: Manage the Operations of Your Airbnb

Effective operational management helps maintain a high standard of guest satisfaction and ensures the smooth operation of your Airbnb. Leveraging technology can significantly streamline this. Advanced tools and platforms can automate many aspects of running a short-term rental, from scheduling cleanings to managing bookings and communicating with guests. This not only saves you time and reduces the risk of errors but also allows you to focus more on providing excellent service and growing your business.

A few notable tech platforms that can help improve Airbnb operations include:

Streamlining these operations can save time, reduce stress, and improve guest experiences, leading to better reviews and more bookings. Read our article on the 6 Best Short-term Rental Management Software.

Frequently Asked Questions (FAQs)

Earnings can vary widely based on location, property type, management efficiency, and market demand. Tools like AirDNA can provide data on local occupancy rates and average daily rates to estimate potential earnings. However, investors should also account for expenses such as maintenance, utilities, taxes, and Airbnb fees.

Common risks include property damage, periods of vacancy, changing regulations, and unexpected operational costs. To mitigate these risks, investors should have comprehensive insurance, establish strict guest screening processes, save for an emergency fund, and stay informed about local laws and market trends. Building a network with other local hosts can also provide support and insights.

The decision often depends on the investor’s time, expertise, and the number of properties owned. Self-managing allows for more personal control and potentially higher profits, but it’s time-consuming and requires a commitment to guest service, marketing, and maintenance. A property management service can alleviate the workload but comes at a cost, typically a percentage of the rental income. Each investor must weigh the trade-offs based on their circumstances and goals.

Bottom Line

When understanding the legal and financial nuances of starting an Airbnb business, investors can make informed decisions that protect their assets. From selecting the ideal property and crafting an appealing listing, to effectively managing day-to-day operations, each aspect plays a vital role in the success of your rental. Leveraging technology and staying updated with market trends are also emphasized to ensure efficiency and competitiveness for the challenging yet rewarding world of Airbnb hosting.